If you’re ready to move on from your current home, you might have asked yourself the question: Should I sell it or rent it out? Let’s explore the nuances of selling versus letting, why one option might be better for you, and how you can plan your next move for the best possible outcome.

Should I wait to sell my house?

Choosing the best time to sell is no easy task. If the housing market is buoyant, you could either wait and see if prices climb further, or strike while they’re already high. There are some reliable seasonal trends which you could follow, but timing will largely depend on the housing market in your local area. National trends may not apply to the market in your location, so it’s important to speak to a localised, experienced agent who can point you in the right direction when it comes to timing and pricing.

Will my mortgage lender let me rent out my house?

It is imperative that you speak to a mortgage adviser and check the small print of your mortgage agreement for any limitations before coming to a decision. Many mortgages will include a clause that disallows you to rent out your property, while some may only allow you to rent it out for up to a year.

If it turns out that you do have to change your mortgage, you’ll most likely have to switch to a buy-to-let mortgage. These mortgage deals often charge higher interest rates, but they also allow you to rent out your home. It’s important that you don’t make this decision overnight, as you’ll have to plan for a variety of upfront costs such as early repayment fees, valuation survey fees, and new mortgage arrangement fees.

Let-to-buy mortgages

Conversely, let-to-buy (LTB) mortgages could be a suitable option if you’re thinking about renting out your home. Unlike buy-to-let mortgages, you can take out an LTB to purchase your next home while renting out your old one. If you have enough equity in your home, you can remortgage and put some cash into a deposit for a new home, then with a let-to-buy mortgage, you can use rental income to cover your monthly mortgage repayments.

Advantages of selling

Achieving a good price

Listening to the advice of an expert agent and setting the right asking price will ensure that you get a great price for your property, which can then be used to purchase your next home.

Using increased value

Some people upsize using the increased value of their current home. If the value of your home has increased significantly since you bought it, you’ll be able to use the funds towards the cost of buying a bigger property. Or, if you’re hoping to downsize, your return on investment can be used as disposable income or placed into a savings account.

Pay less Capital Gains Tax

Capital Gains Tax (CGT) only applies if you’re making a profit from selling a property that is not your main home. Therefore, if the property you are planning on selling is not your main home, you can still pull in a return on your investment without having to worry about CGT.

Advantages of renting out your house

A faster move

You may rent out your house to facilitate a faster move, as you can place an offer on your next home as a ‘chain-free’ buyer, and not have to worry about delays in the conveyancing process.

Additional income

Renting could be a great option if you would benefit more from a steady stream of income, rather than a lump sum. Additionally, if you’re working abroad and plan on returning home at some point, renting it out will supply you with an additional source of income in the meantime.

Value growth

House value steadily grows over the years in which you own the home, so by renting it out for a few years instead of selling, you might be able to achieve a higher sales price, plus any additional income you made from rent.

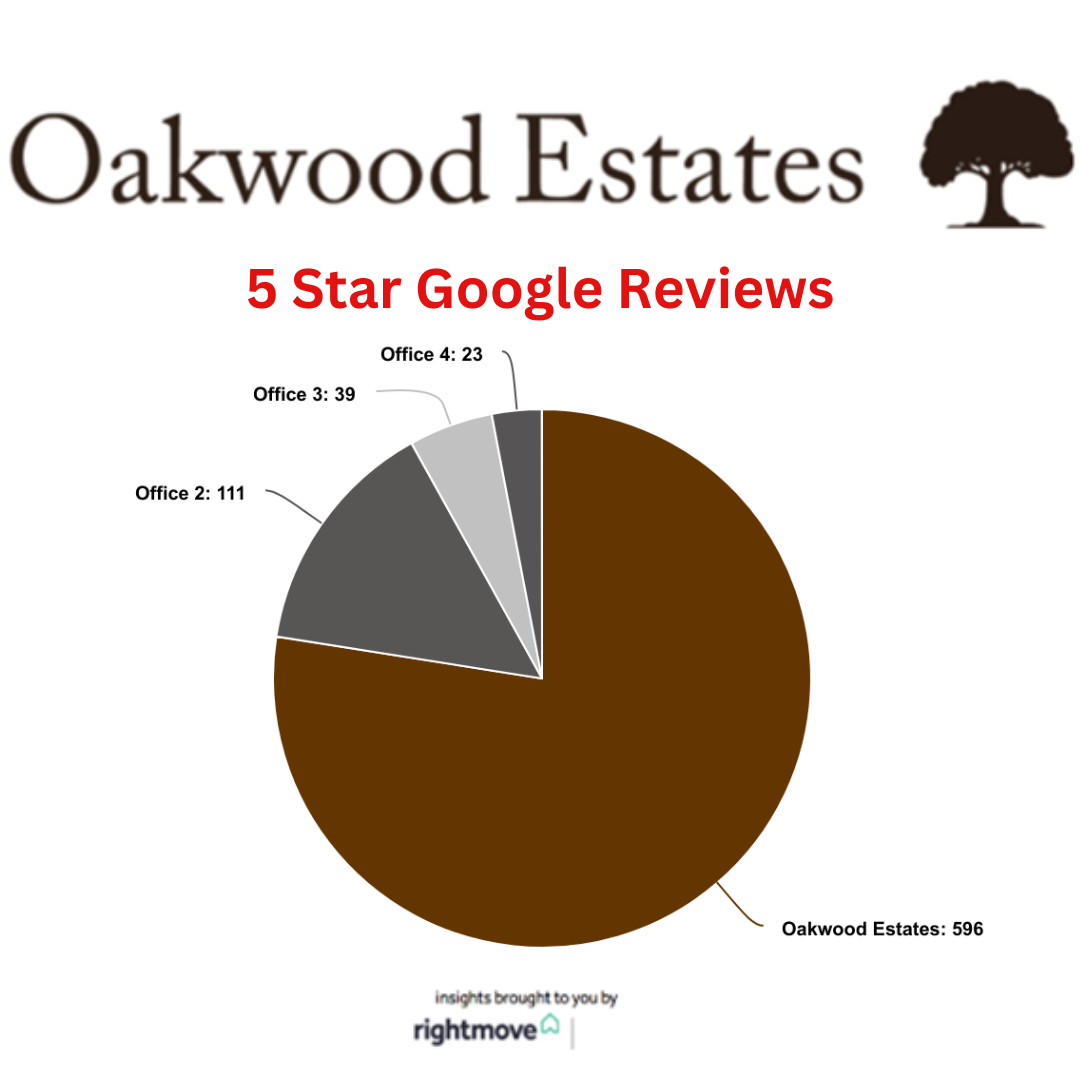

Whether you’re buying, selling, renting, or letting, get in touch with the expert team at Oakwood Estates.

Share this with

Email

Facebook

Messenger

Twitter

Pinterest

LinkedIn

Copy this link